On the other hand, ACORD Form 28 is designed to give persons and organizations that have a financial interest in the property of others a comprehensive view of the property coverages being provided. What was developing as a nightmare for producers having to issue Evidence of Property Insurance ACORD 27 and Evidence of Commercial Property Insurance ACORD Form 28 has now become more of a problem to the certificate holders themselves.įorm 27 is designed for someone, other than a party having an insurable interest in property, who wants to know the types of property coverages being maintained by the party being requested to confirm its property coverages. If you need an insurance binder from an insurer, or you are an insurer and need to collect binder details from multiple clients, then this insurance binder template will do the work for you.Risk Management-Evidence of property insurance changes 01/07ĪCORD makes it clear that the forms are for informational purposes only

Note that an insurance binder will only last for about 30-90 days before it expires hence there's always need to follow up with your insurer until a formal insurance policy is issued. then you will definitely need an insurance binder. Who needs an insurance binder, or when will I need an insurance binder, If you are purchasing a new insurance policy, using a loan to finance your property, or purchasing a new home/car etc. Not everyone needs an insurance binder, and this also brings up questions like

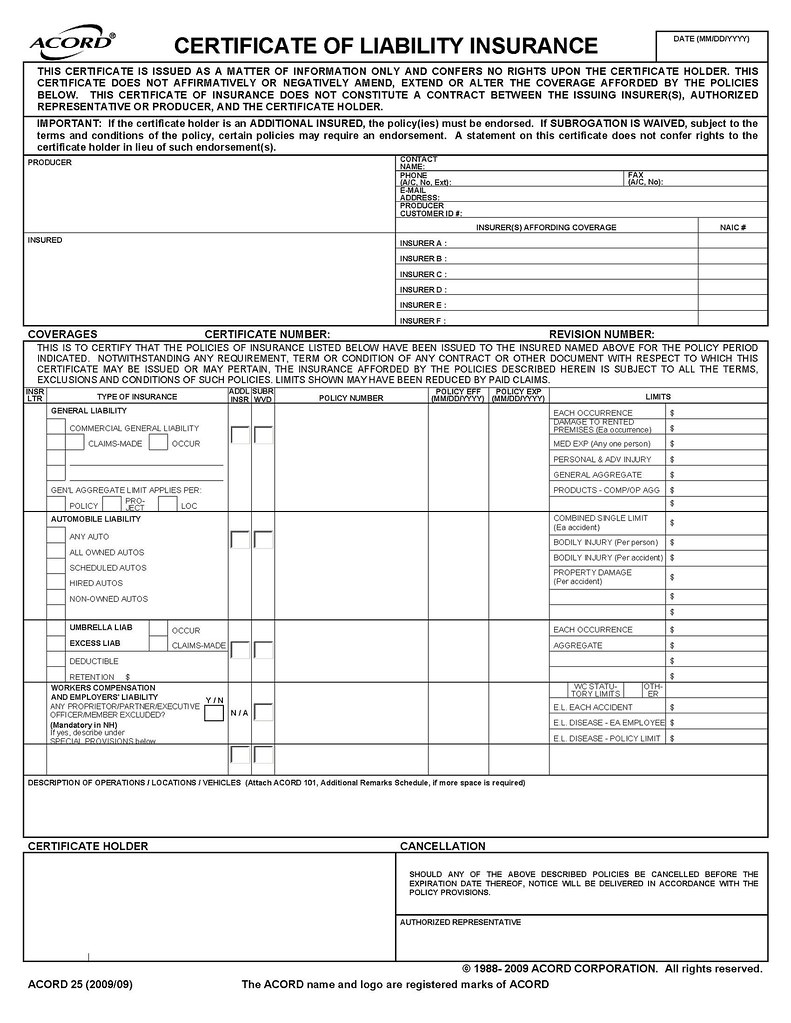

Many who see this template ask questions like: What is an insurance binder, What Is Included in a Binder or what's the difference between a Binder and a Certificate of Insurance.Īn insurance binder (also called Insurance policy binder, Title binder, Interim binder, insurance card) is a temporary contract that guarantees the binder holder of full insurance coverage pending the formal issuance or a rejection of the insurance policy.

0 kommentar(er)

0 kommentar(er)